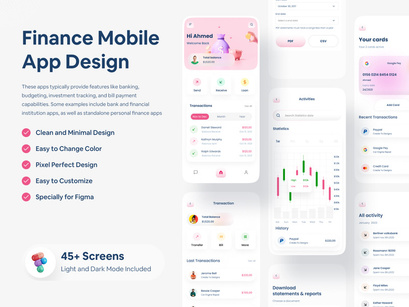

Finance Mobile App DesignPremium

Hey there.

~~~~

Online banking apps typically offer a variety of key features to help users manage their financial transactions and information. These may include:

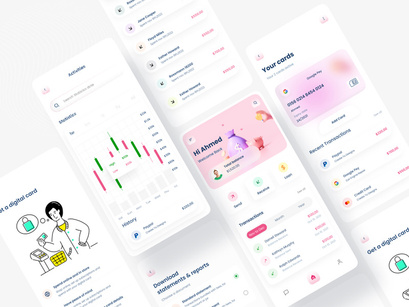

Account management: Allows users to view their account balances, transaction history, and account details.

Bill payments: This enables users to pay bills and set up recurring payments directly from the app.

Money transfers: Allows users to transfer funds between accounts, and pay other individuals or businesses using their phone number or email.

Deposit checks: Allows users to deposit checks using their device camera.

Mobile check deposit: Allows users to deposit checks by taking a picture of them with the mobile device.

Card management: Allows users to view their debit/credit card transactions and control their debit/credit card through the app.

Investment tracking: Allows users to view their investment portfolio and track the performance of their investments.

Budgeting: Allows users to create and track a budget, set financial goals and manage their savings.

Notifications: Allows users to receive alerts for important account activity, such as low account balances or suspicious transactions.

Security: Includes features such as multi-factor authentication, fingerprint login, and encryption to protect users' financial information.

~~~~

Thanks,